Upstream program designs for different DSM measures

In 2018, E Source performed a comprehensive review of 93 midstream and upstream demand-side management (DSM) programs administered by 69 organizations in Canada and the US. This report explores the new measures that program administrators are moving upstream.

The key findings from our study include:

- HVAC measures—such as furnaces, air conditioners, and heat pumps—are playing a bigger role in midstream and upstream programs, surpassing lighting’s popularity as a measure within these program types.

- Residential lighting programs typically incentivize manufacturers and retailers, while commercial lighting programs typically incentivize distributors and manufacturers.

- Customer segments that must replace damaged or broken equipment quickly in order to keep the doors open are good candidates for midstream programs. These businesses, such as restaurants and grocery stores, rely on distributors to get them back up and running.

- When considering whether to move a new measure upstream, look for established relationships between contractors and their supply chain; distributors and manufacturers can provide vital information to contractors on how to sell and install these high-efficiency measures.

- Many programs feature measures that end users can easily install, such as lighting, residential appliances, and consumer electronics.

- If customers can’t purchase an incentivized measure because it isn’t in stock locally, move the measure upstream to encourage stocking and up-sell practices.

Midstream programs give incentives to intermediaries, such as distributors or retailers; upstream programs give incentives to manufacturers. In this study, we included programs that have robust reporting protocols, which means we may not mention some new pilots and programs.

Lighting remains a dominant measure for midstream and upstream programs. Most residential lighting programs go through retailers and manufacturers, while commercial lighting programs go through manufacturers and distributors. As lighting markets transform and baselines rise, utilities are diversifying their midstream and upstream offerings to include several new measures.

HVAC measures are also popular for midstream and upstream programs. In fact, when including heat pumps within the HVAC category, there are more midstream and upstream programs for HVAC than for lighting (figure 1).

Figure 1: HVAC measures are gaining popularity in midstream programs

HVAC equipment

Most HVAC equipment—such as heat pumps, VFDs, and a variety of chillers—require contractors to sell and install the unit, making it an ideal measure type for a midstream or upstream model (figure 2). To decide which channel makes the most sense for a given measure, consider the complexity of the equipment and its installation. For example, if Lowe’s or the Home Depot is selling an HVAC unit that’s easy for customers to install, such as a window air conditioner, set up a point-of-sale discount through the retailer. If a customer needs a larger unit such as a furnace that requires expert installation, design an incentive for distributors and manufacturers. Trade allies typically rely on distributors and manufacturers for information and training on high-efficiency HVAC units, so leveraging the relationships between trade allies, distributors, manufacturers, and retailers is important for a successful midstream or upstream HVAC program.

Figure 2: Popular measures included in midstream and upstream HVAC programs

Commercial food service equipment

Commercial food service equipment is another category of measures that’s moving upstream. Restaurants are good candidates for the midstream approach because owners need to quickly replace failed equipment and are readily influenced by local contractors. Say, for example, a restaurant’s fryer breaks in the morning. The owner must replace it as soon as possible to avoid affecting operations. These customers typically purchase whatever unit is available the soonest and often purchase the equipment through a local distributor. So it’s imperative to ensure that high-efficiency equipment is in stock and recommended by contractors. High-efficiency equipment can be easy to up-sell because it offers faster cook times, leads to higher production rates, and decreases energy bills for restaurants.

Restaurants are good candidates for the midstream approach because owners need to quickly replace failed equipment and are readily influenced by local contractors.

One challenge with this measure moving upstream is that although high-efficiency units are in stock, replacement parts rarely are, which is problematic for customers. High-efficiency equipment is like all equipment: parts break or malfunction. It’s important for customers to be able to repair or replace parts quickly. If there’s a long wait for replacement parts, restaurants may no longer trust energy-efficient equipment, the contractor who recommended the equipment, or the utility program. We’re unaware of any utilities working to address this, but it’s a common concern among contractors who install new, high-efficiency units.

Water heaters

Nine utilities in our study are moving water-heating measures upstream. Water heaters have some similarities to HVAC and commercial kitchen measures as they can be purchased in-store or through a contractor, and customers will typically take whatever unit is available. One advantage of this measure is that contractors often find water heaters an easier measure to properly install than HVAC units because they don’t require ductwork or airflow optimization.

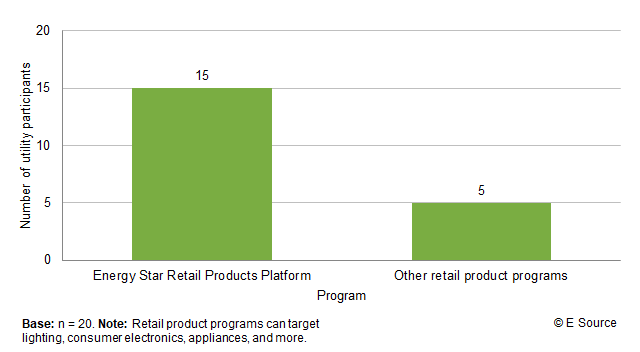

Retail products and appliances

Appliance and retail products are quickly growing within midstream and upstream programs in large part due to the Energy Star Retail Products Platform, a national collaboration between Energy Star, utilities, retailers, and other stakeholders intended to encourage retailers to stock and sell high-efficiency Energy Star–certified products (figure 4). The 2019 program focuses on five measures:

- Clothes dryers

- Clothes washers

- Air conditioners

- Freezers

- Refrigerators

Figure 4: The Energy Star Retail Products Platform is utilities’ primary choice for midstream appliance programs

The Energy Star program targets measures that end users can easily install without a contractor. The program simplifies participation for retailers and offers a low-cost option for utilities wishing to pursue a midstream retail program. It’s a promising way to get midstream program savings without designing and implementing a program from the ground up. The program pays a per-unit incentive to retailers without requiring any money to pass through to the end-use customer.

Five utilities—Tuscon Electric Power, Efficiency Maine, Arizona Public Service, Focus on Energy, and Idaho Power Co.—have their own appliance and retail programs. These programs target lighting measures, appliances, and retail products.

According to Tim Michel, program manager at Pacific Gas and Electric Co., “My advice for a utility wanting to enter [the Retail Products Platform] or start a midstream program is to get together with your regulators and their evaluation team early and often. Each regulator will act different and we all have different rules we operate under. It will be critical to understanding how this new program will be looked at.”

Miscellaneous measures

As utilities continue to expand their midstream and upstream portfolios, we’ll likely see more measures enter this channel. Some of the miscellaneous measures making their way upstream include pool pumps, VFDs, showerheads, windows, and motors. For help figuring out when it makes sense to move a measure upstream, check out our report Swimming Upstream: When DSM Programs Can Benefit from Upstream Incentives.