There’s a strong correlation between how utility customers are treated (or should I say, feel they are treated) and how those customers score their utilities on customer satisfaction (CSAT) surveys. It’s critical for utility personnel to grasp that while CSAT is a great measure, there’s a more impactful correlation to focus on: the one between customer satisfaction and authorized return on equity.

This correlation is important because when we focus on really meeting customer needs—for the sake of this blog post, small and midsize business (SMB) or general service customers specifically—we can observe both an increase in CSAT scores and a commensurate increase in regulated outcomes. That means more money to focus on the programs that make a difference to utilities’ bottom line. So how can utilities consistently address SMB customers’ needs, deliver exceptional value, and get the regulated rate of return they need to drive the utility forward? Let’s explore …

Shift your focus to a customer-centric approach

To drive different outcomes in your service area, take a more customer-centric approach. By combining E Source market research and customer data collection with your customer data, we can build digital replicas of your customers. The result is a more complete understanding of your customers. With the E Source Audience of One solution, you get an individual, customer- and data-focused, preference-based analysis of each customer and advice on how to approach them.

This is a valuable approach and useful for all customer groups, including income-qualified or low- and moderate-income customers. But of real interest is addressing CSAT in unmanaged or undermanaged accounts.

The power in supporting small and midsize businesses

One group in particular—you guessed it—SMBs, may have a disproportionate impact on regulatory outcomes. That’s because SMB owners are active in their communities and have the ear of government officials. If things go sour for SMB owners due to heatwave-induced blackouts or service interruptions, they’re likely to alert their local and state government representatives. This is a problem for utilities because just a few disgruntled SMB owners may have an outsized effect on regulators’ actions.

While many utilities focus on key accounts and larger-revenue customers, the SMB group rarely meets the key account criteria. SMBs are generally part of a larger, relatively unmanaged pool. This can leave the SMB customer sector poorly served, providing an opportunity for utilities to improve CSAT scores.

So what are utilities doing to address SMB issues?

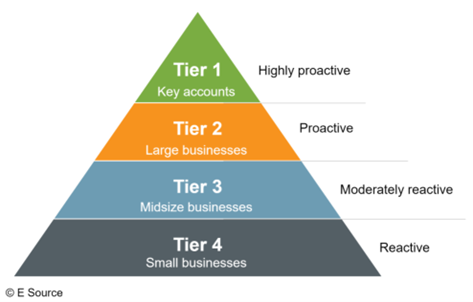

A quick roundup of some of our customers’ actions shows a variety of approaches—some have implemented account tiering to better understand their business customers based on revenue, needs, and level of effort. But such approaches are still largely reactive. They allow a different sorting of segmentation based on criteria, but they don’t tell you much more about the customer.

In contrast, the Audience of One approach is particularly powerful in the SMB sector. We combine data science, hundreds of data points on each customer, and our best-in-class market research analysis to increase your knowledge of each customer and their preferences.

We can aggregate their preferences and your customer account knowledge to develop powerful insights on specific customers. It’s the ultimate way to know your customer.

Why do we care about SMB CSAT anyway?

CSAT is an important measure. Policy-makers and regulators in public utility commissions reference CSAT as they deliberate on rate cases. The overall downward trend in utility return on equity (ROE) authorizations over the past 15 years exerts even more pressure on utilities to address customer satisfaction (figure 1). It’s not just the downward trend, it’s the tightening range that should makes utilities nervous.

Figure 1: Percentage of authorized ROE for electric utilities, 2012–2022

In late 2012, while I was heading up SNL Energy—now S&P Global—I recognized a trend toward lower utility ROE and CSAT scores. So, I started compiling data on ROE and CSAT to see if there was a correlation. We released a report in 2013 in collaboration with J.D. Power that elucidated the relationship. In October 2022, S&P Global and J.D. Power updated and rereleased that report as the Executive Insight Report (PDF).

Rate cases consider many factors. The impact of storm damage on infrastructure, latent drag on the economy as a result of COVID, the need to address carbon, and rising inflation rates all put pressure on regulators and utilities. Add in blackouts, brownouts, and other problems in utility service areas and customers become frustrated that utilities aren’t doing enough. That sentiment can cause regulators to squeeze a utility’s ROE. So, getting customer experience and customer satisfaction right is critical to getting an appropriate rate of return.

Knowing your SMB customers’ preferences takes the mystery out of CSAT

For many utilities, the SMB sector contributes both significant usage and significant revenues. In many cases, SMBs contribute as much revenue as the entire residential sector because rates for SMBs are high and more complex than rates for residential customers. “If it ain’t broke, don’t fix it” can be the default position. Data from the US Energy Information Administration’s Electric Power Monthly show that average prices for the commercial sector rose 11.8% from 2021 to 2022, from $0.1122 per kilowatt-hour (kWh) to $0.1255 per kWh. Customers are shocked to see how quickly their bills rise, so they’re keen to uncover the cause of the charges. Therein lies a great opportunity for engagement, education on rates and tariffs, simplification of charges, and better CSAT scores.

According to the J.D. Power report:

By creating a positive customer experience, and ultimately satisfied customers, regulated electric utilities will continue to receive increased regulatory outcomes and have the continued ability to invest in and support customer satisfaction and the customer experience.

A review of SMB or general services tariffs across utilities reveals a complex set of base charges, capacity charges, and other riders and additions that can be difficult for even long-time rate analysts to decipher. It shouldn’t be a surprise, then, that we continue to see that “ease of doing business” ranks high in importance for customers, but lower in satisfaction. The E Source Business Customer Satisfaction Study is a pair of online surveys of US utilities’ SMB and large business customers designed to assess their most important needs and how well their energy providers are meeting them.

Part of the trouble is that unlike key accounts, utilities deal with SMBs on a reactive basis (figure 2). Dropping or fluctuating satisfaction scores from this group could have a disproportionate impact on the regulated rate of return and affect the utility financially. We suggest taking a more proactive approach, where knowing your customers and their preferences takes the mystery out of the CSAT process and scores.

Figure 2: Level of service for SMB accounts

According to analysis conducted on rate cases by E Source and research conducted by J.D. Power and S&P’s Regulatory Research Associates, utilities with higher CSAT scores get better returns. Not only do higher satisfaction scores result in higher returns, utilities with higher scores also get decisions returned faster—12% faster on average. With decision lag time, the time between filing and approval is almost 10 months for the lower CSAT quartile and 8.5 months for the higher quartile.

While there may be fluctuations in overall ROE, those utilities that are addressing their most problematic customers enjoy hundreds of thousands if not millions more dollars returned per rate case, according to the J.D. Power report (figure 3).

Figure 3: Percentage of authorized ROE for electric utilities by CSAT quartile

Time to get your proverbial hands dirty

What isn’t so obvious is how utilities can make lasting improvements in customer satisfaction. It’s one thing to measure CSAT, but it’s something else entirely to make the right adjustment that leads to measurable improvement. For SMBs, that boils down to two areas:

- Ease of doing business with their utility

- Understanding how they’re billed for electricity

Billing, tariffs, and rates are complicated for SMBs. Develop ways to make it easy for them to do business with your utility. For example, you could offer a prepay option. A standard rate with simple preference adders for reliability would greatly simplify the bill for SMBs, provide transparency and feelings of empowerment, and reduce risk for the utility. Another example would be to improve your self-service features through the contact center and develop a coordinated response for first-contact resolution (FCR).

E Source regularly surveys utilities and their customers to get sense of their needs and preferences around account management and customer satisfaction. For more information, visit the E Source Account Management Assessment and Business Customer Satisfaction Study pages.

Making the commitment to become a proactive organization requires a leadership-driven initiative. Such a change isn’t easy because it demands a shift in psychology and a modification to the utility’s overall approach to risk management. It embraces the need for an organization to recognize the importance of being both proactive and reactive. While both are problem-solving exercises, it can be an easier decision to rely on reaction alone because it may be less costly and require less planning than developing a proactive solution.

We’re working on an FCR benchmark study for utility contact centers. Our analysis will help utilities address standardization of response and gather customer details to delight the customer and solve their problem on the same call. If you’re interested in joining the study, contact us.

Members of the E Source Business Marketing Service can access the E Source Business Customer Insights Center, which provides information about the energy management needs and attitudes of specific business sectors. Pair that with our Audience of One solution and you’ve got the most cost-effective approach to improve SMB customer satisfaction—and your ROE.

Preferences drive many of the ways we want to interact with our service providers—think aisle or window, light or dark mode, security, and risk. Shift your point of view by building a digital replica of each SMB customer. By understanding SMB customer preferences, you can address the unique nature of each effectively and sustainably.

We may be part of a regulated industry, but we can provide unique service for less while changing the relationship with our customers. This will save time and money, and it just might improve your regulated rate of return.