The energy-efficiency industry has published many white papers, reports, and resources advising utilities on how they should approach the uncertainty around the US Energy Independence and Security Act of 2007 (EISA) and whether they should make portfolio changes. E Source has partnered with Claire Miziolek, market strategies program manager for the Northeast Energy Efficiency Partnership (NEEP), to provide a clear, unbiased analysis of the EISA legislation in order to help you plan programs that achieve the most cost-effective energy savings.

It’s clear that lighting will no longer be the key measure in DSM portfolios, but EISA presents an opportunity to make your programs cost-effective and tailor them to customers’ needs.

During the 2018 E Source Forum session Mind the Gap! Leading Your Utility into the Next Generation of Savings, Miziolek discussed the evolution of EISA and outlined the three most likely scenarios for how the lightbulb standard will play out. Here, we summarize the scenarios, explain what you can expect from lighting programs going forward, and describe actions you can take today to prepare for the changing market.

Planning for uncertainty from EISA

It’s clear that lighting will no longer be the key measure in DSM portfolios, but EISA presents an opportunity to fine-tune your programs—making them cost-effective and tailoring them to customers’ needs. The effect of EISA is just one factor to consider in a world of rapid market transformation, decreasing avoided costs, and integrated distributed energy resource strategies. By adapting DSM portfolios to prepare for EISA, utilities are finding ways to enhance the customer experience, test and implement new technologies, and go after the highest-value energy savings. These portfolio changes are necessary and valuable regardless of what happens with EISA.

The EISA timeline

EISA was designed to transform the general-service lamp (GSL) market, and it established two phases of standards for GSLs.

Phase 1:

- Directed the market to begin phasing out incandescent bulbs in 2012 and move to halogen lamps by 2014

- Covered the import and manufacture of lamps, so the burden of compliance was on manufacturers

Phase 2:

A backstop provision was written with phase 2 to act as an insurance policy to achieve the new standards by ensuring that policy goals would be met regardless of present-day politics.

- Directed the market to move to LEDs and CFLs by 2020

- Mandated that the US Department of Energy (DOE) make a next-phase rulemaking that would achieve an average efficiency of at least 45 lumens per watt (lm/W) by January 1, 2020

A backstop provision was written with phase 2 to act as an insurance policy to achieve the new standards by ensuring that policy goals would be met regardless of present-day politics. That backstop provision mandated that if the DOE failed to complete a rulemaking by January 1, 2017, a standard of 45 lm/W would take effect on January 1, 2020, and retailers could be penalized for selling noncompliant lamps.

So where are we now?

- The DOE failed to complete the procedural steps laid out in EISA, including making a GSL final rule by January 1, 2017, thus triggering the backstop, which is now in effect with a compliance date of January 1, 2020.

- Under President Obama, the DOE issued two final rules in January 2017 that broadened the definition of GSLs to include reflector, decorative and candelabra-base, three-way, shatter-resistant, vibration service, and rough service lamps; and included a higher lumen limit.

- Meanwhile, the LED market share has grown and CFLs have started to vanish from the Energy Star program, utility programs, and the market. Most utility programs had planned for a blended baseline from 2012 to 2020, with a CFL baseline in 2020, but the market has changed more rapidly than anticipated.

The DOE’s three possible EISA scenarios

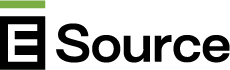

We’ve outlined three scenarios for the DOE’s potential courses of action around EISA (Figure 1) and the lawsuits they could trigger:

- The DOE allows the sale of halogens after January 1, 2020. This move would be legally vulnerable on several points, and state attorneys general would have the authority to enforce a ban on halogen sales.

- The DOE takes no further action before January 1, 2020. As with the first scenario, this move would be legally vulnerable on several points, and state attorneys general would have the authority to enforce the halogen sales ban.

- The DOE issues the 45 lm/W GSL standard. The rule would take effect on January 1, 2020, and would potentially advise “enforcement discretion” to allow manufacturers to sell their back stock.

Figure 1: Will the DOE allow the sale of halogens, issue the baseline standard, or do nothing at all?

Advice for how to prepare for EISA

We don’t know what will happen in 2020, but you can develop a more resilient portfolio by taking action now to capture remaining lighting savings, begin phasing out programs, engage with regulators, and start implementing next-generation programs and strategies (Figure 2).

Figure 2: Preparing your portfolio for EISA

It’s not 2020 yet, so it still makes sense to offer residential lighting programs. Focus on robust programs for Energy Star–qualified lighting through 2019, and make plans to transition away from those programs. There may be a longer program opportunity for specialty lamps, which may offer inefficient alternatives beyond 2020. For retail A-lamp incentives paid after January 1, 2020, utilities risk low attribution or none at all, even if the DOE allows manufacturers to sell through their noncompliant lamps for a period of time.

The courts and retailers will likely determine what’s on store shelves.

The courts and retailers will likely determine what’s on store shelves. Some halogens may be available on January 1, 2020, but if retailers start to incur fines, they might not stay on shelves for long. California has already implemented the 45 lm/W backstop, starting at the beginning of 2018. Many other states—including Vermont, Rhode Island, Connecticut, Maryland, and Pennsylvania—are planning to phase out residential lighting programs and expect the 45 lm/W standard to take effect by 2020.

Start educating regulators today about your needs for tomorrow. Residential lighting is a dynamic measure used in programs to fill shortcomings from other residential measures or gaps from commercial and industrial programs, but it will no longer play that role after 2020. Utilities will need more flexibility going forward to achieve their goals and will need to work proactively with regulators to do so. We aren’t sure what the reality will be in 2020, but we do know that when you take lightbulbs out of the equation, efficiency programs will need to look elsewhere for savings.

Although there’s no such thing as an ideal cost-effectiveness test, there are ways to update existing cost-effectiveness test parameters to better reflect the changing market and to better account for the benefits from distributed energy resources. The National Standard Practice Manual from E4TheFuture discusses the movement to revise cost-effectiveness tests and helps define policy-neutral principles for cost-effectiveness tests and key inputs based on state goals.

After traditional residential lighting programs diminish, there will be an opportunity to transform the commercial lighting market with LED lighting controls.

Start planning for your next generation of programs. Behavioral programs and midstream programs have demonstrated their ability to achieve cost-effective savings. We’ve also seen utilities successfully measure meter-based energy savings and account for the higher value of daytime energy savings. After traditional residential lighting programs diminish, there will be an opportunity to transform the commercial lighting market with LED lighting controls. Finally, utilities are adopting or looking into codes and standards programs as a new hedge against uncertainty.

The E Source report DSM programs for a postlighting world provides more details on these next-generation program types. We’ll continue to report on these trends and provide updated programmatic and technological resources. If you have a unique strategy and would like us to feature your utility in our Next Generation of Energy Savings project, contact us.