Most of the US and Canada have been in COVID-19 confinement for a month. That means you’re about to get your first utility bill after staying at home for four weeks.

More likely than not, you don’t have to worry about losing your gas, electric, or water services during the COVID-19 pandemic. Moratoriums on utility disconnections are widespread, either by government mandate or utility policy. Via the March 19, 2020, press release Helping Customers During This Time of Need: All EEI Member Companies Suspend Electricity Disconnects, Edison Electric Institute (EEI) members, which include all US investor-owned utilities, pledged to end disconnections during the crisis.

This provides temporary relief if you’re financially affected by the pandemic. But you may need long-term support from your utility so you don’t build up large balances that you have to pay later. Here’s some advice to help you manage your utility account and reduce your financial burden as you recover from the COVID-19 crisis.

Set up payment arrangements with your utility and ask for time to pay them off

Contact your utility company now to set up payment arrangements. Avoid calling the customer service line because call centers have limited staff and are overwhelmed by emergency calls. Instead, set up arrangements through your utility’s website. Companies like Pacific Power, Xcel Energy, and ComEd describe payment arrangement options, allow customers to see their eligibility, and let customers complete their payment plans entirely through the website.

Right now, utilities are extending due dates and deferring payments. We found several examples.

FortisBC has one of the most developed COVID-specific payment arrangement offerings at this time: the COVID-19 Customer Recovery Fund. Customers can enroll in the program to have bills deferred from April 1 through June 30. Repayment will be applied across 12 months and be interest-free. Both residential and small business customers can participate.

Colorado Springs Utilities (CSU) offers three options: a due-date extension, a customized payment plan, and a “skip your payment” option. This last option lets customers skip paying the current month’s bill and roll it into the next month’s or subsequent months’ bills. Read the details on CSU’s Flexible Payment Plans web page.

City of Tallahassee started a Utility Relief Program that defers payments until the fall and will bill customers in installments from September 2020 through March 2021.

Eversource is offering a flexible payment plan that allows residential customers to participate without a down payment and for any balance amount. Business customers are also eligible for extended payment plans. The utility’s Payment Plan web page details more.

Your utility can connect you with assistance programs that it operates, that the federal government operates, or that local charities operate.

Enroll in assistance programs

Payment plans can help you manage your bills, but what do you do if you lost your job or had your hours cut because of COVID-19 stay-at-home mandates? Simply having more time to pay may not be enough for you. Your utility can connect you with assistance programs that it operates, that the federal government operates, or that local charities operate. Programs like the Low Income Home Energy Assistance Program (LIHEAP) help families pay their energy bills and make energy-efficiency upgrades in their homes.

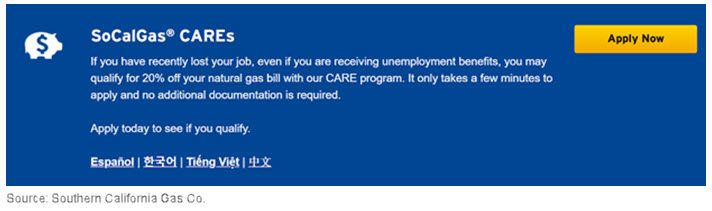

COVID-19 has created a new class of financially strapped utility customers who may not know what programs are available to them. Knowing this, utilities are proactively promoting their existing assistance programs on their website and on social media. For instance, Southern California Gas Co. (SoCalGas) created a campaign to raise awareness of the California Alternate Rates for Energy (CARE) discount. This state program provides a 30% to 35% rate discount on electric service and a 20% discount on natural gas to low-income customers. With a wider pool of qualified customers, SoCalGas is promoting the program on social media and makes it easy for customers to apply on its website (figure 1).

Figure 1: CARE on the SoCalGas website

Utilities are also widening eligibility guidelines for financial assistance and creating new funds to help customers pay their bills. Some utilities are even offering credits or assistance to all of their residential customers.

The City of Lawrenceburg in Indiana is paying all residential utility bills for its customers in May and June, as detailed in the Dearborn County Register article L’burg to Pay Residents’ Utility Bills, Help Out Businesses.

FPL lowered customer bills for May due to fuel cost savings, according to its press release FPL responds to ongoing COVID-19 pandemic by lowering customer bills for the second time this year. FPL used to split the savings throughout the year. But due to COVID-19, the utility is issuing the decrease all at once to provide a greater relief to customers. Residential customers should see a 25% reduction in their May bill.

BC Hydro is providing three months of bill credit to customers who have lost their job because of the pandemic. The Canadian utility bases credit amounts on average monthly usage over the past year. Read more on BC Hydro’s COVID 19 Relief Fund for residential customers web page.

Avista Utilities partnered with the city of Spokane, Washington, to boost funds to two community assistance programs per the Spokesman-Review article Fundraising effort aims to help those behind on utility bills in Spokane. Both the utility and the city are matching every dollar donated by customers.

JEA is giving residential customers a bill credit that will cut bill amounts by approximately $25 in May. The utility will automatically apply the credit to its customers’ bills.

Tacoma Public Utilities (TPU) and Snohomish County PUD are offering emergency bill credits to customers in need. TPU customers making 200% of the poverty line can receive up to $250 and Snohomish County PUD residential customers in need can receive up to $200. Snohomish County PUD business customers can get up to $500.

Ask your energy provider to help you find creative solutions to paying your bill.

Watch your budget bill charges

If you do budget billing with your utility, where you pay a set amount every month based on your projected energy usage over 12 months, you may end up having to pay a big bill at the end of the year. You’re likely spending more time at home than ever, which means you’re using more energy than ever. That will affect your end-of-year payment. For example, let’s say your total energy costs for 2019 were $1,200. And let’s say that based on that number, your 2020 budget billing program has you paying $100 per month. If your total energy costs in 2020 are $2,000, you’ll have to pay an additional $800 at the end of the year. Talk to your utility about using a different method to project your 2020 energy usage.

Ask your utility to work with you

Your utility understands that this is a difficult time for everyone. Ask your energy provider to help you find creative solutions to paying your bill. Chances are they’re more than willing to work with you.