Customers are looking for a trusted partner and a go-to source for reliable information about EVs. Utilities can be that partner by understanding who the future EV buyers are, meeting them where they are, and providing essential outreach and education.

Using data from the E Source 2023 Electric Vehicle Residential Customer Survey, we created two EV customer personas—customers who are thinking about buying an EV in less than three years and customers who are thinking about buying an EV in three to five years. As you’re planning your marketing for EV products, programs and services during the next five years:

- Consider the unique home and building characteristics to personalize messaging to specific groups.

- Educate about the costs to purchase and maintain an EV.

- Develop online resources about EVs and local charging networks, like mobile apps or web pages.

- Increase community outreach by hosting local EV events or attending events in collaboration with community organizations and dealerships.

What customers are the next wave of EV buyers?

Customers looking to buy an EV—battery EVs (BEVs) or plug-in hybrid EVs (PHEVs)—within the next few years look, think, and act differently than the current EV owner. They’re part of different demographics and have different behaviors.

Because of these differences, utilities need to change the way they serve these customers. Utilities will also need to update how they engage with and market to these new customers.

Customers who are thinking about buying an EV in less than three years

Respondents who said they’re thinking of buying an EV in less than three years lack information about EVs and how and where to charge the vehicles. They’re also more concerned about costs compared to current EV owners.

What are the characteristics of this customer group? Most customers who are thinking about buying an EV in less than three years own single-family homes (70%). But they’re more likely than current EV owners to:

- Live in MFH properties

- Live in suburban or rural areas

- Have lower incomes

Customers who are thinking of buying an EV in less than three years compared to current EV owners

Where does this group get information about EVs? Customers who are thinking about buying an EV in one or two years are more likely than current EV owners to have actively sought out information about EVs by speaking to someone and searching online.

Utilities should position themselves as trusted resources and make information easily available for these customers. For example, utilities can reach customers who are looking to buy an EV by:

- Creating inclusive messaging for different customer segments within multifamily communities.

- Connecting with local partners to build credibility and trust and spread essential information about EVs.

- Making educational resources available across multiple channels.

What are this group’s vehicle habits and buying preferences? Compared to current EV owners, customers looking to buy an EV in less than three years are more likely to:

- Use their personal vehicle as primary transportation

- Use primary transport most often to run errands or take short trips around town

- Drive 20 miles or fewer in a day (US only)

- Prefer to buy vehicles in person at a dealership

- Prefer to get information about vehicles in person at a dealership

- Buy a BEV next

Customers who are thinking about buying an EV in three to five years

Respondents who said they’re thinking of buying an EV in three to five years have had mostly passive interactions with EVs. Compared to current EV owners, they’re more likely to have only:

- Read about EVs

- Seen EV commercials

- Seen EV chargers in their area

They lack knowledge about EVs in general and information about how and where to charge EVs. This customer group also said cost is an important factor influencing their consideration to buy or lease another vehicle compared to current EV owners.

Customers who are thinking of buying an EV in three to five years compared to current EV owners

What are the characteristics of this customer group? Survey respondents who said they’re thinking of buying an EV in three to five years are more likely to:

- Be 55 or older

- Be female

- Have median incomes

- Live in MFH properties

What are this group’s main barriers to purchasing an EV? Customers who are thinking about buying an EV in the next three to five years said their top barriers to purchase are:

- The costs of owning a BEV

- Not knowing the effect an EV would have on their electric bills

- A lack of general familiarity with EVs

- A perceived lack of public charging

What are this group’s vehicle habits and buying preferences? Compared to current EV owners, customers who are thinking about buying an EV in the next three to five years are more likely to:

- Use their personal vehicle as primary transportation

- Use primary transport most often to run errands or take short trips around town

- Drive 10 miles or fewer in a day (US only)

- Prefer to buy vehicles in person at a dealership

- Prefer to get information about vehicles in person at a dealership

- Buy a PHEV next

How can utilities reach upcoming EV buyers?

The next wave of potential EV buyers interacts with EVs in unique ways compared to current EV owners. Consider how your utility can meet these customers’ needs with its promotional and educational materials.

Costs and rebates are important to future EV buyers

These customers were more likely to consider financial factors as important in their consideration of EVs. Design materials that help customers understand the costs of owning an EV and the ways they can save money. Specifically address the concerns around how an EV will impact their electricity bills.

Understanding rebates. Future EV buyers were more likely to say that information on available tax credits would help them when they’re considering EV costs. Utilities can provide clear information on their website and in marketing materials about utility, state, and national EV rebates. Along with explaining what customers are qualified for certain rebates, explain how customers can combine available rebates.

Perception of EV affordability. Future EV buyers were much less likely than current owners to agree that EVs are affordable for the average person. At the end of 2022, the average price of a new EV was just over $60,000. But future EV buyers are looking to pay $20,000–$50,000 or less for their next vehicle.

Luckily, there are many available EVs within this price range. Consider sharing more-affordable offerings with customers. For example, in its article Affordable, all-electric: The 5 lowest-priced new EVs in the US, Green Car Reports details affordable EVs in the US market.

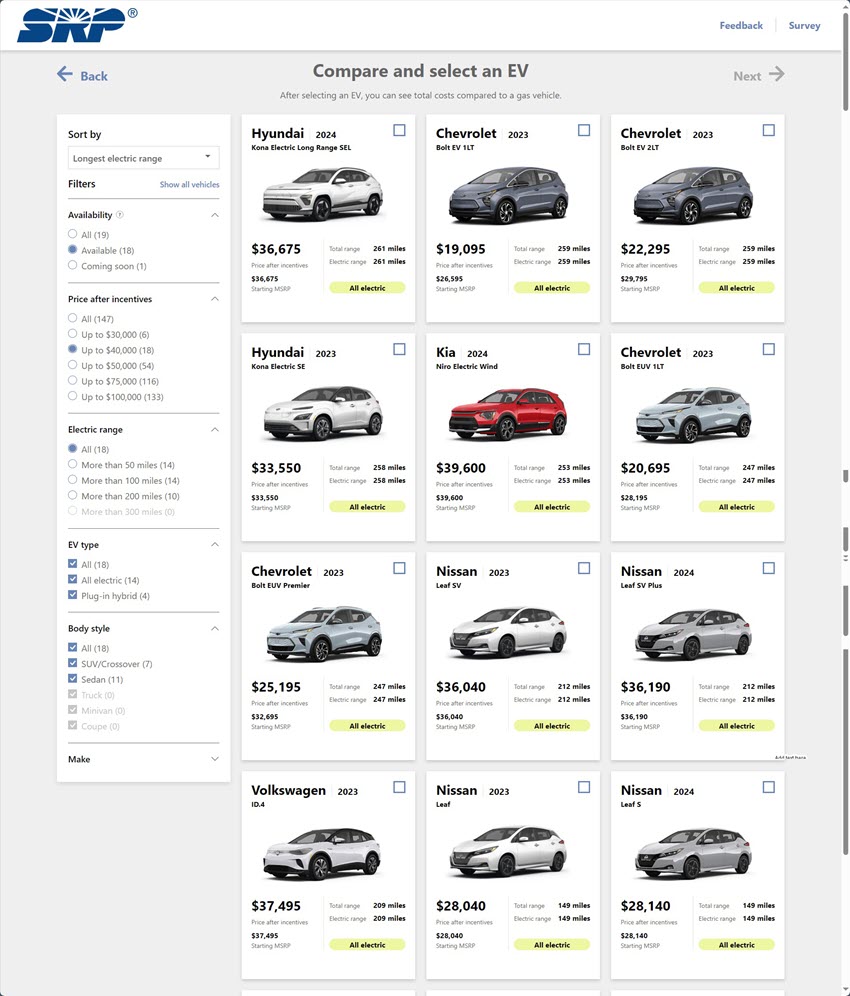

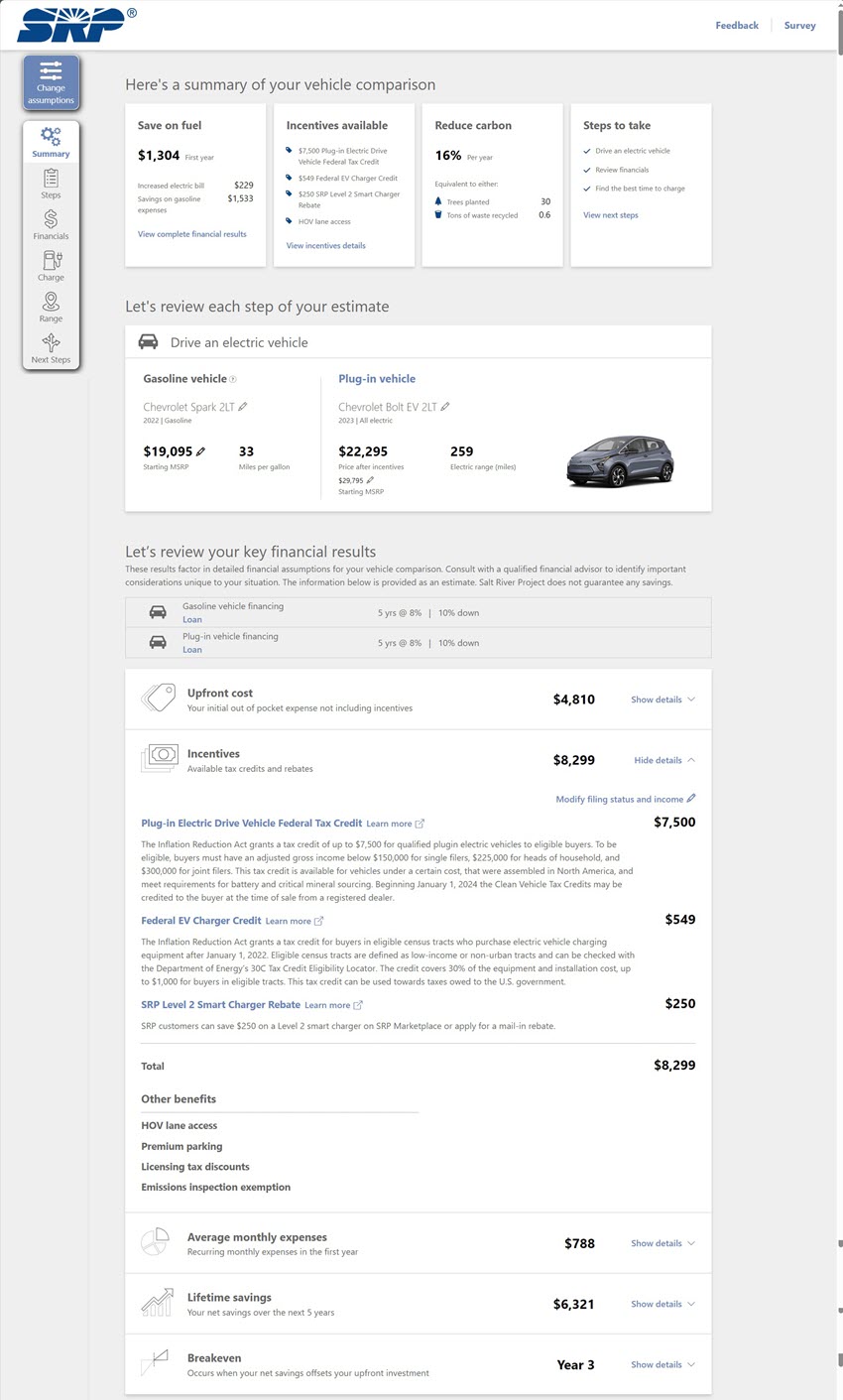

Calculating EV costs. Future buyers said that being able to access a total cost of ownership calculator would be a perk or benefit that could persuade them to buy an EV. Provide examples of EV cost calculations on your website and use marketing materials to show customers the actual cost to purchase after rebates.

Consider also offering an online calculator to make it easier for customers to understand the costs and affordability of EVs. For example, SRP works with WattPlan, a cloud-based software company, to provide an online calculator. Customers can use this calculator to compare the cost of EVs to gasoline-powered vehicles.

SRP’s online calculator

Future EV buyers still lack information on where and how to charge an EV

The next wave of EV buyers isn’t sure where to go for accurate information on EVs. Find ways to fill this knowledge gap and position your utility as a trusted source on all things EV.

Knowledge about EV charging is still lacking. Future EV buyers were more concerned about costs and aren’t aware of where or how to charge an EV. Use your website and marketing materials to clearly explain how customers can charge their EV with a standard outlet from their garage or apartment parking lot. Consider also providing example calculations of driving mileage to show how often customers need to charge their vehicle.

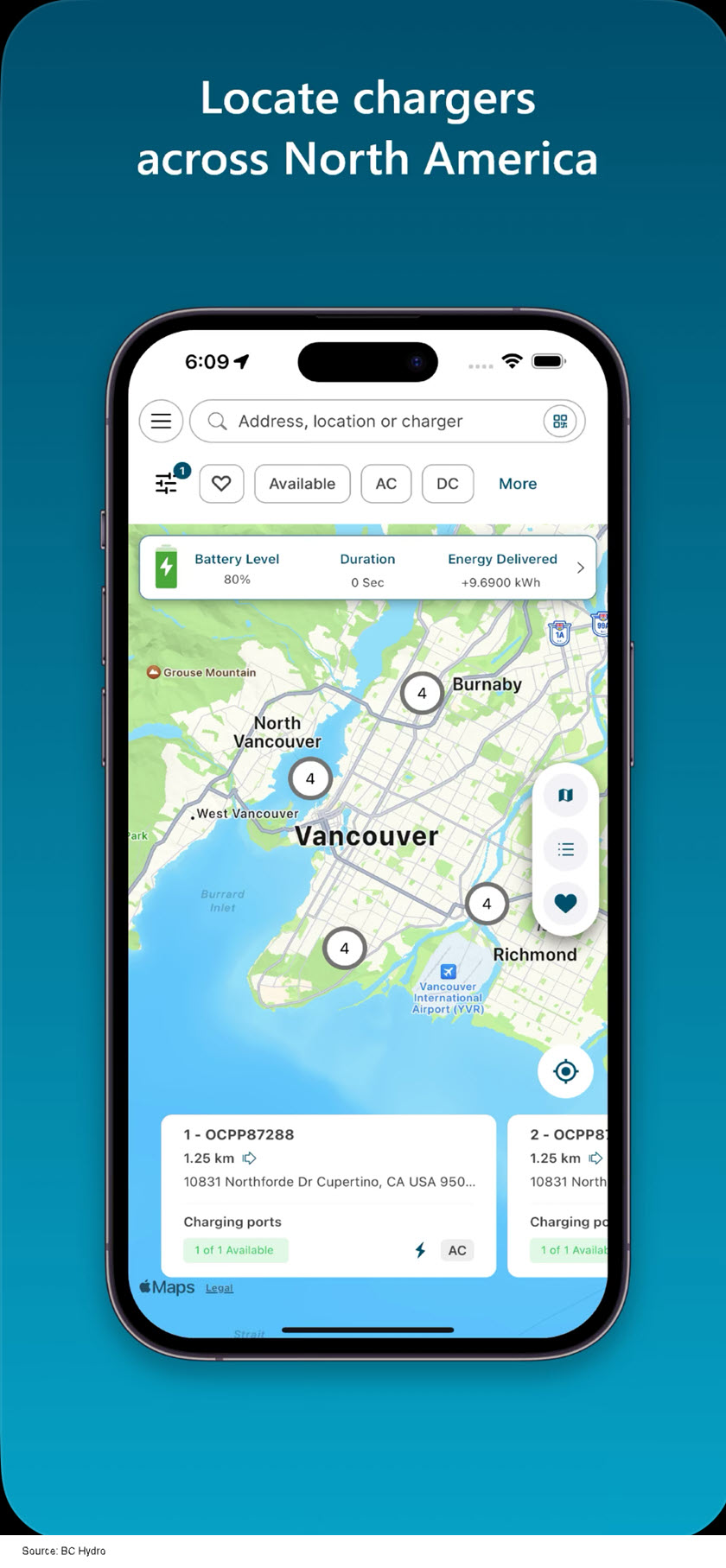

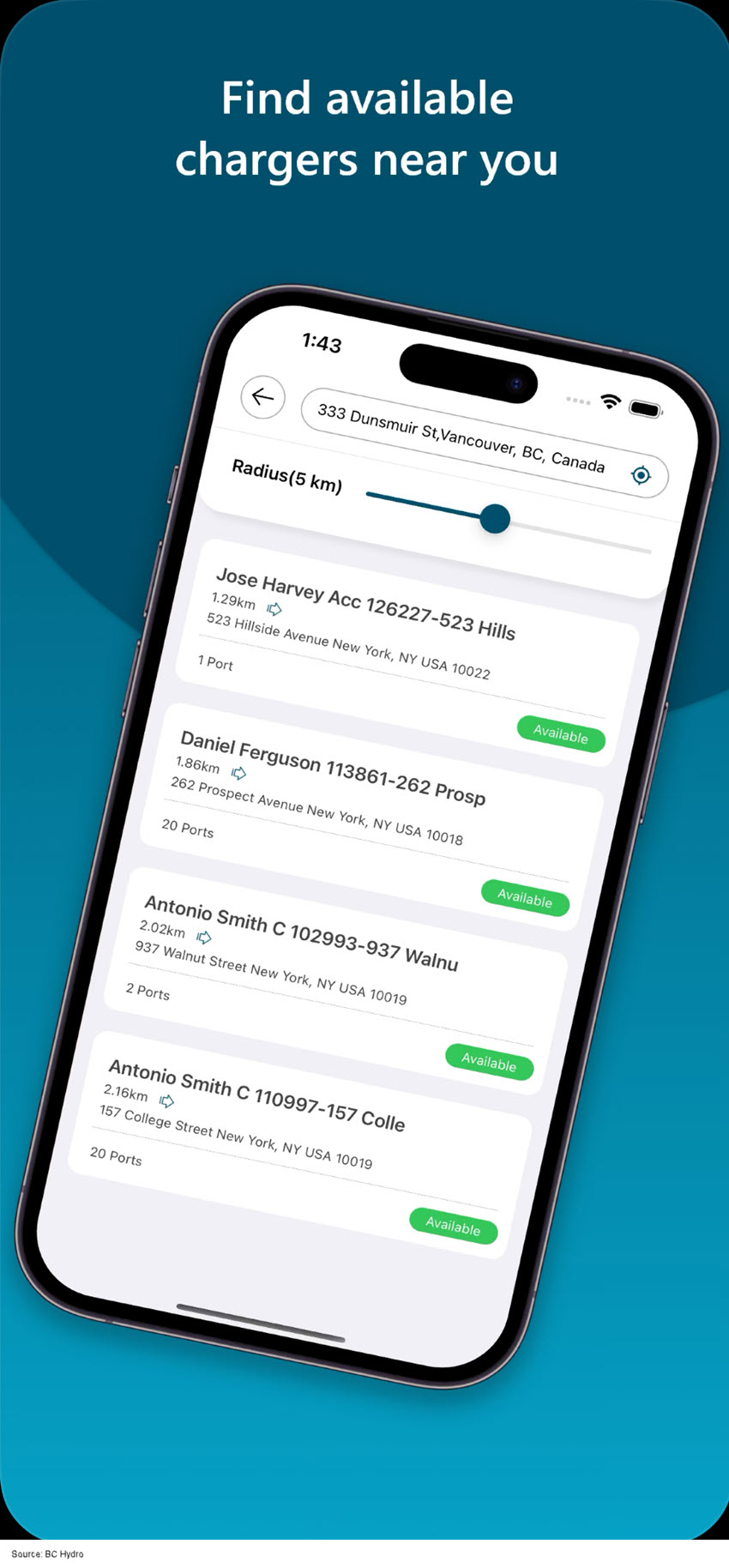

Perceived lack of access to public charging. Public charging can make EV ownership more accessible and help ease some customers’ range anxiety. But future EV buyers may not know about public charging options in their area.

Consider adding a public charging map to your website so customers can easily find public charging in your service area. BC Hydro created the Fast charging mobile app to help its customers easily find public charging stations.

BC Hydro’s EV fast charging mobile app

Future EV buyers are looking for a trusted source of information

Around half of respondents looking to buy an EV in the next five years agreed they knew who to trust for reliable and unbiased information about EVs. These customers most often said they’d turn to a dealership for information on their next vehicle.

But when asked how they’d prefer to hear about BEVs from their electric utility, email, the utility website, and in person were most preferred. Use customers preferred channels to provide information to your customers.

The utility website. Your website is a great starting point to create an EV resource and build your brand as a trusted energy adviser. Answer common questions such as:

- “Will I need to install an EV charger at home?”

- “What are the different types of EV chargers?”

- “How long does it take to charge an EV?”

To learn more about building a trusted information source for customers, check out the Ask E Source answer What information and tools should be included on a utility’s EV website?

Email and print. The next EV buyers were more likely to prefer to hear about EVs from their utility through email or print. Consider using email marketing campaigns or newsletters to share EV information with your customers.

Read our report Design emails and newsletters your customers will read for tips on designing engaging and effective email communications.

EV dealerships. The next EV buyers were more likely to prefer to hear about EVs in person. Utilities and dealerships can work together, along with nonprofit organizations, to improve the EV customer experience and communicate essential information early in the buying journey. They can also:

- Offer dealership staff training

- Use websites to cross-promote

- Hold ride-and-drive events